Guide to the Best Car Insurance with Direct Asia Singapore

Life is uncertain. It doesn't matter how careful you are, you might end up getting hurt or worse due to your or someone else's mistakes. In such cases, insurances offer an added sense of security against these odds and uncertain times. Among all the insurance types, motor or car insurance is one of the most popular kinds.

Car insurance protects you if your vehicle is stolen or vandalized. When you are insured, you may drive with peace of mind and without continuously worrying about mishaps. There are some incidents where your driving skills don’t matter and you can still encounter an accident while saving yourself. And having car insurance can then save you from costing yourself a fortune.

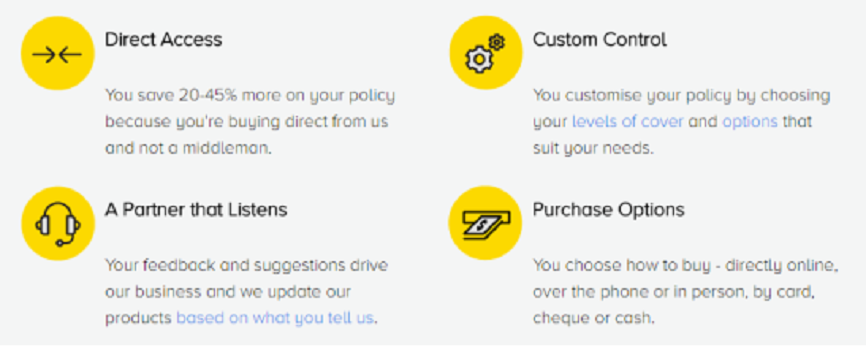

Many car insurances are expensive, however, Direct Asia is Singapore's premier insurance firm that provides consumers with reasonable insurance policies. It strives to develop its company approach and seeks to flourish as a brand. Direct Asia provides travel, automobile, and motorcycle insurance. There could be hundreds of reasons why you need car insurance, but in this curated guide, we will shed some light on the insurance plans, types, perks, newest promotions, and why you need car insurance handy.

Types of Direct Asia Car Insurance:

Direct Asia provides four kinds of car insurance that cover different requirements based on consumers' needs. Let's dig into this further.

Third Party Only – If you don’t want to spend a hefty amount you can opt for third-party-only insurance which covers legal costs and expenses following a car accident, damages to someone’s property, and injury to someone else in the accident.

Third-Party Fire & Theft – It is for individuals who want to go beyond basic coverage and incorporate fire and theft damages caused in an accident. It covers the damages if your car is stolen.

Comprehensive – This one is for the complete peace of mind of the insured as it covers the maximum damages. Including the basic coverage with fire and theft, it covers damages to the car if you crash into a third-party vehicle or something else besides a car, damages by flood or natural disaster, and any damage to the windscreen or windows. It is best suited for individuals who are looking for long-term protection.

SOS Car Insurance – Preferred for those who have had trouble getting insurance and require coverage to get back on driving. If a driver has had their insurance refused, terminated, or 2+ fault claims/accidents in the last 3 years, they can go with the Direct Asia SOS Car Insurance.

You can further customize your car insurance policy after you have selected your cover with Direct Asia’s optional benefits. You can get the instant quote online and then choose your coverage plan with additional add-on perks. To give you more detailed information, let’s discuss the optional benefits.

- Medical expenses – If you or any passenger is injured in a car accident, you will receive up to S$3,000, which is applicable for all cover types.

- 24-hour breakdown assistance – You will be provided with roadside assistance if your car breaks down.

- New for an old replacement car - The same model car will be replaced in case of total loss or steal.

- Get S$50 maximum to 10 days for transport when the car is being repaired.

- You get to choose your workshop for repairs.

- Reimbursement of up to S$200 per person and S$3,500 for the vehicle to towing back to Singapore from West Malaysia and Southern Thailand.

- You will get up to S$500,000 in case of death or loss of limbs due to an accident.

Sometimes a single car is driven by various family members and needless to say, they all have different driving skills and preferences. In that case, Direct Asia states that before you decide on your coverage plan, it is equally mandatory that you share the correct information about the main driver and car usage to help Direct Asia Singapore to give you the most accurate premium of your policy. Meanwhile, you can use our Direct Asia promo code for extra savings during the checkout.

Requirements and Eligibility

In order to qualify and proceed to get suitable car insurance, you will have to follow the eligibility criteria. The main driver should have at least 2 years of driving experience and must be aged 70 and below. No driver should have their license cancelled or suspended in the last 5 years. The policyholder must be the registered owner of the vehicle in order to receive the claims from Direct Asia Singapore.

You can stand a chance to secure maximum savings on your car insurance with Direct Asia’s promotions. For consumers aged between 56 to 70 years get to enjoy 1-month free car insurance when they sign up for the new insurance. Get an additional 10% off when you take insurance for two or more cars. Receive $125 worth of shell fuels whenever you insure the car, the offer is valid for a limited period of time.